Health Insurance’s Future: Trends and Forecasts for 2030 and Beyond

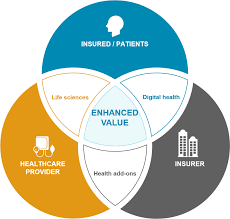

Technology breakthroughs, changing demographics, and altering consumer expectations are all contributing to the healthcare industry’s extraordinary rate of change. The future of health insurance will probably be influenced by a combination of innovation, customization, and a reexamination of conventional approaches as we approach 2030 and beyond. The main trends and forecasts for the future of health insurance will be discussed in this article.

The growing application of big data analytics and artificial intelligence (AI) is one of the biggest shifts in the health insurance sector. Insurers are already able to provide more individualized and customized health insurance because to these technologies.

Predictive analytics: Insurers will be able to forecast future health risks and provide more customized plans by utilizing the massive volumes of data from wearables, health apps, electronic health records (EHR), and social determinants of health (SDOH). This implies that a plan with more focused interventions may be provided to an individual with a history of diabetes in order to better manage that condition.

Behavioral Health: It’s probable that insurers will begin integrating behavioral health information (such as lifestyle decisions and mental health) into their risk assessments. Precision Medicine Integration: As genetic testing and personalized medicine gain popularity, insurance policies may start to pay for genetic tests and therapies that are specific to each person’s genetic composition.

- Virtual care and telemedicine as standard services

Most health insurance policies are anticipated to include telemedicine and virtual healthcare services, which surged during the COVID-19 epidemic. Health insurance in the future is probably going to include:

Remote Consultations: Patients will have greater convenience and access to care as routine consultations, mental health therapy, and even follow-up visits become more prevalent through telemedicine platforms.

Expansion of Telehealth Coverage: Telehealth will become a routine benefit offered by insurers. Indeed, as part of basic coverage, some plans may even provide limitless virtual consultations, particularly for mental health and primary care services.

Telemedicine with Artificial Intelligence (AI): AI-powered virtual health assistants could help with case triage, guiding patients Health Insurance’s Future in choosing the best course of action for non-urgent medical concerns,

- Preventative Care Health Insurance

A form of health insurance that prioritizes preventive care may replace one that is only reactive in the future. Insurers are focusing Health Insurance’s Future more on prevention as global healthcare systems struggle with the expense of managing chronic diseases.

Wellness Incentives: More wellness initiatives that compensate individuals for adopting good habits (such as exercising, eating a balanced diet,Health Insurance’s Future and quitting smoking) are probably going to be offered by health insurers. Discounts, lowered premiums, or even monetary prizes for leading a healthy lifestyle could be some examples of these incentives.

Proactive Risk Management: In order to identify any health issues before they worsen and lower long-term healthcare expenses, plans may provide access to genetic testing, health screenings, and even proactive management technologies.

Chronic Disease Management

To help those who are at risk of acquiring chronic diseases like diabetes or heart disease, insurers may provide specialized programs that use continuous health monitoring devices to act early and lower the long-term costs of treatment.

Payment Reform: Payment methods that incentivize providers for enhancing patient outcomes, cutting expenses, and preventing readmissions to hospitals are probably going to be adopted by insurers. This will result in less focus on pointless treatments and more effective, coordinated care.

The combination of behavioral, social, and physical health services is promoted by value-based care. In order to provide more comprehensive care,Health Insurance’s Future particularly for those with complicated medical needs, insurers may collaborate with healthcare providers.

- The Growth of Health Plans Driven by Consumers

Consumer-driven health insurance models will become increasingly prevalent as more people seek more control over their medical care.

Growth of Health Savings Accounts (HSAs)

As more people want more control over their healthcare choices, HSAs and other tax-advantaged accounts that let people save for medical costs are probably going to grow in number.

Transparent Pricing: In order to empower customers to make knowledgeable decisions regarding their treatment, there will be an increasing demand for price transparency.Health Insurance’s Future Customers may find it easier to shop for care if insurers offer more transparent pricing for medical procedures, treatments, and prescription drugs.

Health Insurance’s Future

On-Demand Insurance: More people may start using flexible, on-demand insurance options. For instance, gig workers may find pay-per-use insurance or short-term health plans appealing.

- Models of International Health Insurance

More nations might take inspiration from international health insurance models as healthcare costs rise. Here are a few significant trends:

Cross-Border Coverage: As the world grows more interconnected, people may seek out international insurance, particularly when traveling, working,Health Insurance’s Future or residing overseas. It’s probable that international insurers will broaden their product offerings to include other nations.

Public-commercial Partnerships: Some countries may develop hybrid insurance programs that combine commercial supplemental insurance for Health Insurance’s Future premium services with government-subsidized basic coverage. Governments and insurers will collaborate to provide affordable, all-inclusive policies for a larger population.

- Blockchain for Fraud Prevention and Transparency

Blockchain technology offers a safe, open, and decentralized method of storing and exchanging data, which has the potential to revolutionize the health insurance sector.

Data confidentiality: By using blockchain technology, insurers can lower the risk of fraud and data breaches while ensuring the confidentiality of private health information Health Insurance’s Future

Claims Processing: Blockchain technology has the potential to expedite the claims procedure, cutting down on administrative expenses and delays. Payments could be automatically triggered by smart contracts when specific criteria are satisfied.

Interoperability: Blockchain may make it easier for patients, healthcare professionals, and insurers to communicate with one another and access medical records on various platforms Health Insurance’s Future

- Health Equity and Social Determinants of Health

A major forecast for health insurance in the future is a greater focus on tackling social determinants of health (SDOH), which include housing, transportation, education, income, and access to wholesome food. The connection between these variables and general health outcomes is becoming more widely acknowledged by health insurers.

Health Equity: More initiatives aimed at lowering health inequalities, such as specialized treatments for underserved populations, will probably be included to health plans as they develop.

Social Support Networks: As part of a larger initiative to enhance health outcomes for a variety of populations, insurers may start paying for non-medical services like social work, housing assistance, or medical appointment transportation Health Insurance’s Future

In conclusion, the future is patient-centered, inclusive, and innovative.

The following traits will define health insurance in the future:

Even if there are still issues, particularly with regard to regulation, data protection, and guaranteeing fair access, the trends and forecasts for the upcoming ten years show promise for a more flexible and patient-focused health insurance market. The way we approach healthcare will change as a result of the convergence of technology, individualized care, and a stronger emphasis on wellness and prevention. This will provide people all around the world more possibilities to live longer, healthier lives.