Which Health Insurance Company Makes the Most Money

Health insurance is essential for protecting against unanticipated medical costs, and the profitability of health insurance providers shows how well they manage risk, premiums, and payouts. Since it depends on a number of variables, such as revenue, profitability margins, market presence, and the company’s overall financial health, identifying the most lucrative health insurance provider is a challenging endeavor.

This article will look at some of the most successful health insurance providers in the market, evaluating their business strategies, financial performance, and unique selling points.

Leading Health Insurance Providers based on Profitability

In recent years, a small number of health insurance corporations have dominated both the domestic and foreign markets and are routinely ranked as the most profitable Makes the Most Money participants in the sector. These businesses consist of Humana, Cigna, Anthem, and UnitedHealth Group. Let’s take a closer look at these businesses.

Makes the Most Money

- The UnitedHealth Group

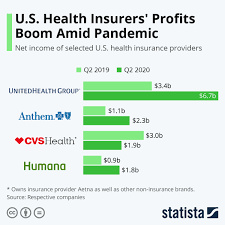

With significant revenues and earnings, UnitedHealth Makes the Most Money Group is generally considered to be the most lucrative health insurance provider in the US.

Revenue: More than $400 billion a year

Profit: The company’s net income often ranges from tens Makes the Most Money of billions to over $20 billion in recent years, according to reports.

Optum, which offers pharmacy services, healthcare technology, and consulting, and UnitedHealthcare, which offers health insurance products and services, are the two main business segments of UnitedHealth. The

- Anthem, Inc.

Another significant participant in the health insurance market, Anthem is now Elevance Health and is renowned for its broad reach and high profitability.

Revenue: around $145 billion each year

Profit: Anthem’s net income usually exceeds $5 billion, and the company often posts profits in the multibillion-dollar level.

The core of Anthem’s business strategy is providing a variety of insurance products, such as Medicaid and Medicare Advantage plans, as well as individual and group health insurance policies. Its profitability has been driven by its significant Medicaid market Makes the Most Money share and its effective transition to value-based care. The organization can better control costs and enhance client outcomes because to its integrated health services approach, which blends insurance with healthcare delivery.

Anthem has been investing in technology to improve its digital health operations.

- Cigna

Global health services provider Cigna is well-known for its impressive results in the US market, especially in the areas of foreign health insurance Makes the Most Money and employer-based health plans.

Revenue: around $180 billion per year

Profit: Cigna consistently announces annual earnings of well over $5 billion.

Cigna’s wide range of products, which include life, dental, and health insurance, contribute to its profitability. The business has also had great success integrating its operations, using advancements in customer service and technology to spur expansion.

Cigna’s remarkable profitability can be attributed to its ability to streamline operations and provide more affordable services through its 2020 acquisition of Express Scripts, one of the biggest pharmacy benefit managers.

Additionally, Cigna’s emphasis Makes the Most Money on providing wellness programs and managing chronic diseases has allowed it to keep a competitive edge while

- The Humana

With a heavy emphasis on Medicare Advantage plans and health services, Humana is another significant player in the health insurance market.

Revenue: around $100 billion each year

Profit: Humana frequently makes more than $3 billion in net income.

With millions of customers enrolled in its plans, Humana is especially well-known for its domination in the Medicare Advantage market. Because Makes the Most Money the company specializes in serving the aging population, which is still growing in the United States, it has seen significant profitability.

In order to control patient outcomes and cut expenses, Humana’s business strategy also places a strong emphasis on integrated care and tight collaboration with healthcare providers.

The company’s profitability has also been significantly Makes the Most Money influenced by its foray into the healthcare services sector, which includes collaborations with physicians and hospitals. By providing

Elements That Affect Their Profitability

These health insurance businesses’ exceptional profitability is a result of several important factors:

Economies of Scale: Major economies of scale enable big health insurance to distribute administrative expenses over a bigger client base, increasing their profitability. Additionally, these businesses increase their profits by negotiating better prices with healthcare providers.

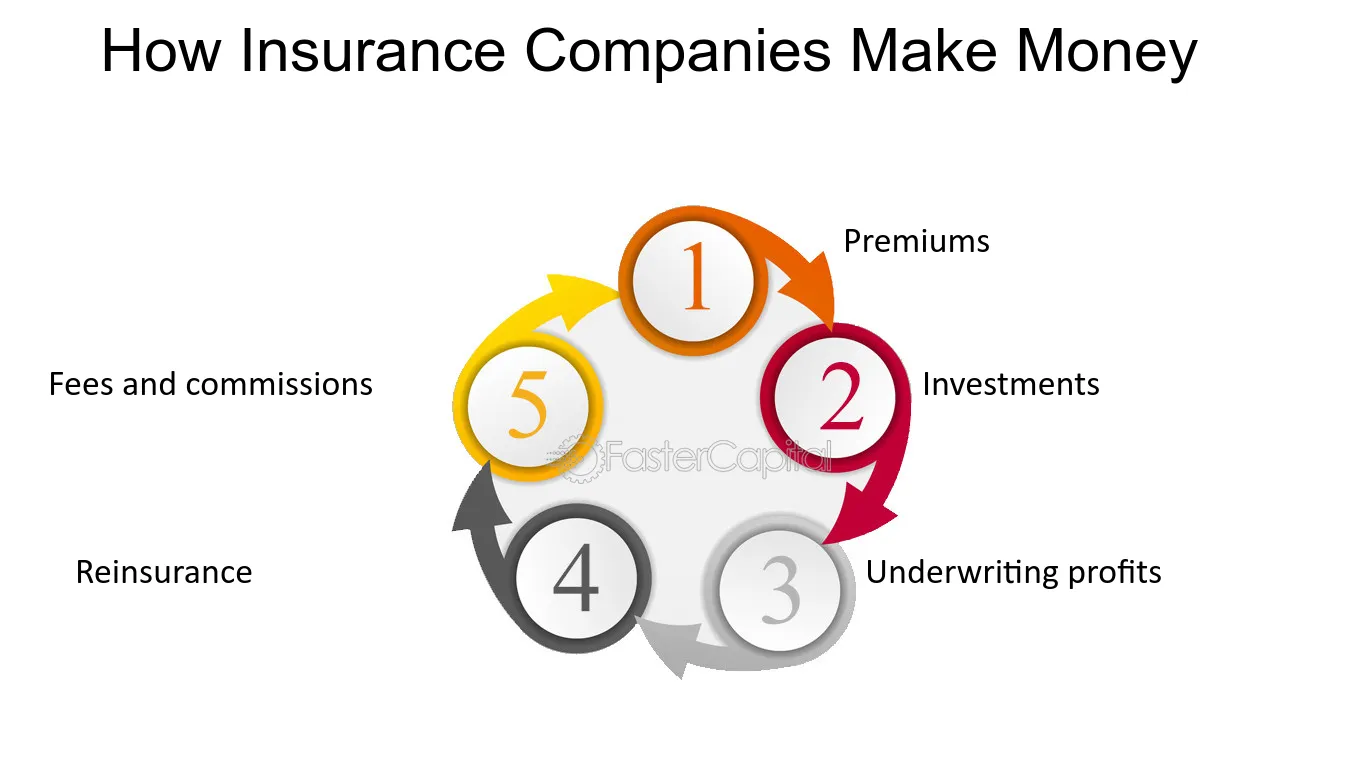

Diversification of Services: In addition to providing traditional health insurance, many of the leading health insurance companies have expanded their business models. For example, Cigna’s Express Scripts and UnitedHealth’s Optum have greatly increased their service offerings, decreasing their dependency on premiums and increasing their overall income.

Contracts with the Government: One of the main factors driving these programs’ profitability has been the rising demand for government-sponsored healthcare, such as Medicaid and Medicare Advantage plans.

Innovation in Care Management: By emphasizing preventative care, managing chronic diseases, and enhancing patient outcomes, many of these businesses have made investments in innovative technologies and care management initiatives that lower healthcare costs. This enhances client happiness while assisting insurers in keeping costs under control.

Strategic Mergers and Acquisitions: By eliminating operational redundancies, acquisitions like Cigna’s acquisition of Express Scripts or Anthem’s acquisition of Beacon Health Options enable health insurers to grow their market share, consolidate services, and boost profitability.

In conclusion

Companies like UnitedHealth Group, Anthem (Elevance Health), Cigna, and Humana have continuously shown themselves to be the most lucrative in the health insurance sector, despite the fact that profitability might vary depending on market conditions, laws, and healthcare trends. Their business plans, which incorporate economies of scale, diversification, and