have grown in popularity recently as a way for individuals and families to reduce their medical insurance costs. An HDHP is a type of health insurance plan that usually has lower monthly premiums but a larger deductible than regular plans. Although this could sound alluring, it’s vital to take into account the plans’ advantages and disadvantages. The benefits and drawbacks of HDHPs are examined in more detail below.

High Deductible Health Plans’ Benefits: Cheaper Monthly Premiums

The reduced monthly payment is one of the biggest benefits of an HDHP. The insurance provider is able to charge less for the plan because you are willing to spend more out-of-pocket before insurance coverage begins (through the deductible). Because of this, High Deductible HDHPs are a desirable choice for people who are generally healthy and do not expect to incur large medical bills.

Qualifications for Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs), which enable people to set aside funds for medical costs tax-free, are frequently combined with HDHPs. An HSA allows for tax-deductible contributions, tax-free growth of the funds, and tax-free withdrawals for approved medical costs. For people who qualify, this triple tax advantage can be very advantageous.

High Deductible

Greater Transparency and Consumer Control

A higher deductible might make people more conscious of how much they spend for medical care. Customers are more likely to look for the most affordable treatment choices when more HDHPs urge them to compare services. Furthermore, more pricing transparency may be provided by healthcare providers, assisting people in making better decisions regarding their care.

Coverage of Preventive Care

Preventive care services (including immunizations, screenings, and wellness visits) must be provided by HDHPs at no cost to the insured, even before the deductible is paid, as required by the Affordable Care Act (ACA). People may be inspired to take preventative measures and manage their health more actively as a result.

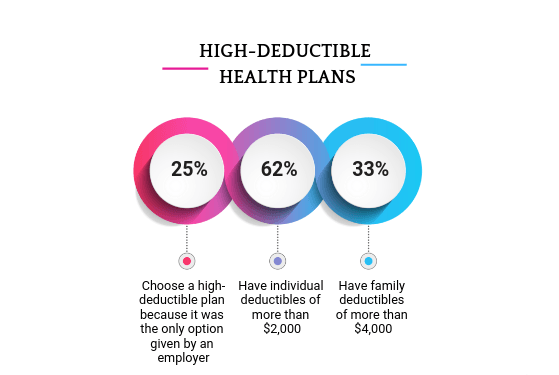

High Deductible Health Plans’ Drawbacks: Higher Out-of-Pocket Expenses

HDHPs have cheaper monthly rates, but they come with a higher deductible that must be paid before medical costs are covered by insurance. If you have unforeseen medical expenses, this can be a major hardship, particularly for people who need frequent medical attention, have chronic illnesses, or are part of a family with small children.

Risk to Finances

There is a higher financial risk because of the large deductible. Before their insurance coverage begins, people may have to pay hefty out-of-pocket expenses in the event of a major illness, accident, or medical emergency. Significant financial burden may result from this, especially for people without sizable emergency savings.

Unsuitable for Individuals with Chronic

It’s Hard to Budget for Medical Costs

Because the deductible must be satisfied before your plan begins to pay for the majority of services, HDHPs make it challenging to estimate how much you will have to pay out of pocket. Budgeting may become difficult as a result, especially if you are unsure of the therapies that may be required or when you might require medical attention.

Postponed Care

Some people may put off or avoid getting the care they need until their health problems worsen because of the hefty upfront expenses connected with HDHPs. Delays in treatment may result in lower health outcomes and increased long-term expenses for rehabilitation and medical bills.

Potential Effect on Care Access

Some HDHP sufferers might be less likely to go to the doctor for routine examinations.

In conclusion

For healthy people who are able to handle higher out-of-pocket payments in the case of unforeseen medical needs, high deductible health plans can provide substantial savings. The attractiveness of HDHPs is further increased by the possible tax benefits provided by Health Savings Accounts (HSAs), particularly for individuals wishing to prepare for future medical expenses. The expenses, however, may exceed the advantages for those with long-term illnesses, families with significant medical requirements, or those who lack the funds to pay a high deductible.

Your unique healthcare requirements, financial status, and risk tolerance all play a role in selecting the best health insurance plan. As with any significant financial choice, it’s critical to thoroughly consider an HDHP’s short- and long-term effects to ascertain whether