How to Get a Job in Pakistani Insurance Companies

Pakistan’s insurance sector has been expanding quickly and provides a variety of job options. The industry serves workers from a wide range of disciplines, from actuarial science and customer service to sales and underwriting. Knowing the employment market and taking the appropriate actions will improve your chances of success if you want to work in the insurance industry.

This is a comprehensive tutorial on how to get a job in Pakistani insurance businesses.

- Recognize Pakistan’s Insurance Sector

Understanding the industry is essential before beginning a job search. Reinsurance, general insurance, health insurance, and life insurance are all part of Pakistan’s insurance market. Important participants in the market include:

Retirement planning,Get a Job in Pakistan life risk, and other associated services are covered by life insurance companies.

Companies that provide general insurance protect assets such as cars and real estate.

An Islamic substitute for traditional insurance is takaful.

Reinsurance: Offers coverage to insurance providers.

It’s crucial to choose Get a Job in Pakistan which area of the industry best suits your interests and skill set because each section offers a variety of employment options.

Educational Requirements

While the insurance industry in Pakistan accepts applicants from a wide range of educational backgrounds, having relevant qualifications can significantly increase your chances of landing a job. Business & Finance Degree: A bachelor’s or master’s degree in business administration (BBA/MBA), finance, economics, or accounting is typically preferred. Actuarial Science: For actuarial roles, a degree or certification in actuarial science or statistics is essential.

Insurance-Related Courses: Some institutions in Pakistan and overseas offer specialized courses in insurance, risk management, or underwriting. Professional Certifications: Certifications such as those from the Chartered Insurance Institute (CII) or Pakistan’s Insurance Institute of Pakistan (IIP) are highly valued.

3. Acquire Relevant Experience

Internships: To gain an understanding of how the insurance sector operates, begin with an internship at an insurance company. Many businesses provide university students and recent graduates with paid or unpaid internships.

Soft Skills: Attention to detail, problem-solving abilities, excellent communication skills, and customer service are essential. Interpersonal and negotiating abilities are essential while applying for sales positions.

Technical Skills:

Proficiency in data analysis, programming, and actuarial software such as SAS or R might be advantageous for actuarial positions or claims processing.

Sales and Relationship Management:

If you’re looking for a job in client Get a Job in Pakistan acquisition or retention, having experience in direct sales, marketing, or customer relationship management (CRM) will help you stand out.

- Making connections

In Pakistan’s cutthroat insurance Get a Job in Pakistan sector, networking is essential to getting a job. You could:

Go to Industry Online networking: Make connections with insurance industry professionals by using sites such as LinkedIn. Keep up with business Get a Job in Pakistan pages and interact with their content.

Industry Groups: Participate in forums and professional groups where professionals discuss trends, job openings, and insights.

How to Get a Job in Pakistani Insurance Companies

- Examine Various Positions

- Risk manager: Responsible for Get a Job in Pakistan evaluating and reducing the company’s financial risks.

- Developing marketing plans and advertising insurance goods are the main focuses of marketing and communications.

- Apply for Positions at Prominent Insurance Firms

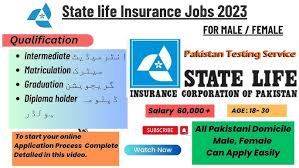

When you’re prepared, begin applying for positions at respectable insurance firms. Among Pakistan’s leading insurance providers are: - Jubilee Life Insurance, State Life Insurance Corporation of Pakistan

- Investment Company EFU Life Assurance in Pakistan, Oman

- Adamjee Insurance, Takaful Pakistan, and MetLife PakistanKnowing the range of opportunities available in the insurance industry can help you choose the best career path. Typical job titles include the following:

Sales Manager/Sales Executive: In charge of promoting insurance plans to customers directly or via middlemen.

Underwriter: An underwriter establishes the conditions of insurance policies by assessing risk.

Claims Officer: They evaluate, confirm, and handle policyholder claims.

Actuary:

Actuaries use statistical techniques and frequently work with big data sets to examine financial risks and uncertainties.

Customer service agent: Responds to consumer inquiries,

The majority of these businesses advertise job openings on LinkedIn profiles, job boards, and their official websites. To locate pertinent jobs, you can also search online employment portals such as Bayt.com, Mustakbil.com, and Rozee.pk.

- Get Ready for Interviews

To impress the employers, make sure you are well-prepared for the interview. Here are some pointers for a successful interview:

Examine the business: Learn about the company’s background, offerings, and services. Be passionate about the company’s principles and mission.

Display Your Capabilities: Emphasize your relevant experiences and abilities. Be prepared to give instances of your prior use of these abilities.

Knowledge of the Industry: Review the latest developments in Pakistan’s insurance industry, including changes in consumer behavior, regulatory reforms, and technology breakthroughs.

Pose inquiries: Get some intelligent questions ready to ask.

- Make an effort to advance your career

Continue honing your knowledge and abilities after landing a job. Since the insurance sector is ever-changing, keeping abreast of new developments in technology, legislation, and trends will help you progress in your work. To advance your career, get certified, go to training courses, and actively look for mentorship possibilities.

In conclusion

With the correct combination of education, experience, and networking, one can get employment in Pakistan’s insurance industry. You can succeed in this exciting area if you keep yourself updated, acquire the required abilities, and target the correct organizations.

There are many chances for both professional and personal development in the insurance sector, regardless of your career goals—be they sales, underwriting, or actuarial science.