Are Services from Any Doctor Usually Paid for by a Health Plan

One of the first things you should know when signing up for a health insurance plan is how medical services are covered. Whether a health plan will cover treatments from any doctor or if there are restrictions on the healthcare providers you can see are frequently asked questions.

The details of your insurance policy and the kind of health plan you have will determine the answer to this question to a considerable extent. Health plans might differ in how they organize access to doctors, but generally speaking, they are made to strike a compromise between cost containment and service access.

Health Plan Types

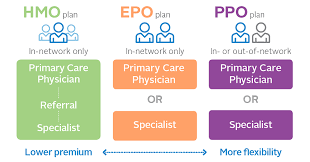

Your ability to see any doctor you want depends in large part on the type of health insurance plan you have. The following are the most typical plan types:

Organization for Health Maintenance (HMO)

Your coverage is usually restricted to a particular network of physicians, hospitals, and healthcare providers when you have an HMO plan. You often Services require a recommendation from your primary care physician (PCP) in order to see a specialist or obtain specific types of care.

This implies that the plan often won’t cover services from any doctor who is not part of the HMO network, unless you are having a medical emergency.

Organization of Preferred Providers (PPO)

Compared to HMOs, PPO plans provide greater freedom. Although they have a network of hospitals and doctors that they choose, you

The main distinction between PPOs and Exclusive Provider Organization (EPO) plans is that the former often do not cover treatments from out-of-network providers, with the exception of emergencies. Similar to HMOs, the plan only covers care received inside the EPO network, but references are not required to see specialists.

Are Services from Any Doctor

Point of Service (POS) programs incorporate elements of PPO and HMO plans. It’s usually handled like an HMO plan if you utilize an in-network physician, and you could require referrals for specialized care. You can, however, choose to see a doctor who is not in your network, but the out-of-pocket cost will be higher. Although these plans have some of the same cost-control features as HMOs, they offer greater flexibility.

High Health Deductible Out-of-Network vs. In-Network Suppliers

In-network and out-of-network providers are distinguished by the majority of health insurance policies. Physicians, hospitals, and other healthcare providers who have entered into an agreement with your insurance plan to offer treatments at pre-negotiated rates are known as in-network providers. Seeing out-of-network providers, who are not under contract with your insurance company, frequently results in the insured paying more out of pocket.

In-Network Care: Your health plan will usually cover a sizable amount of the cost when you see an in-network provider. Although the patient must pay co-pays, deductibles, and coinsurance, these costs are usually less than what they would have if they had seen an out-of-network practitioner.

Out-of-Network Care: Your insurer may pay less for care provided by an out-of-network physician, and you

Special Cases and Exceptions

Even while a health plan normally does not cover out-of-network care, there are specific situations in which it may pay for treatments from doctors who are not part of the network.

Emergencies: Most health plans must pay for care in the event of an emergency, even if you see an out-of-network provider. Laws like the No Surprises Act, which shields individuals from unforeseen medical expenditures resulting from emergency care provided outside of their network, require this.

Referral to Out-of-Network Providers: Your health plan may authorize treatment with an out-of-network physician, Services occasionally at in-network rates, if an in-network provider is unable to perform a certain service. This frequently calls for your healthcare provider’s prior approval and cautious coordination.

Benefits Off-Network: Certain health plans, especially Important Things to Think About

Cost Differences: You should budget for increased expenses even if your plan does cover care from doctors who are not in your network. Higher deductibles, co-pays, and coinsurance are a few examples of these, along with the possibility of balance billing, in which the doctor bills you the difference between what the insurer pays and what they bill.

Access to Care: Greater access to physicians and specialists outside of the insurance network is one benefit of PPOs and other more flexible plans. But this freedom has a cost, and when choosing a healthcare plan, the expense of receiving care outside of the network should always be taken into account.

Plan Networks: Every year, insurance networks might shift, and even a physician who was previously in-network may now be out-of-network. It’s crucial.

In conclusion

In conclusion, the sort of health plan you have determines whether or not it will cover treatments from any doctor. PPO and POS plans give you greater choice, but HMO and EPO plans typically compel you to use in-network physicians.

However, unless you are in an emergency or have specific coverage for out-of-network treatment, seeing out-of-network doctors will usually Services result in greater out-of-pocket expenditures. It’s critical to thoroughly read your health insurance policy, comprehend network Services limitations, and decide where to get medical care depending on your needs and the design of your plan.