Knowing the Fundamentals of Health Insurance

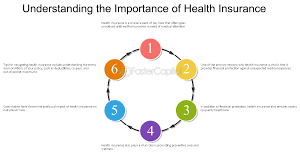

Because it protects against the high expense of medical care, health insurance is an essential part of personal financial planning. Making educated judgments regarding your health care needs begins with knowing the fundamentals, even though there are many plans, jargon, and options to take into account. We’ll go over the basics of health insurance in this post, including what it is, how it operates, important phrases to understand, and the various kinds of plans that are available.

Health insurance: what is it

One kind of insurance coverage that covers the policyholder’s medical, hospital, and surgical costs is health insurance. Prescription medications, mental health services, preventive care, and dental or vision care are just a few of the extra services that may be covered, depending on the plan. Policyholders pay a monthly premium to an insurer, who then assists in covering the costs when medical services are required, rather than having to pay for healthcare bills out of pocket.

Important Elements of Health Insurance

It’s crucial to become familiar with a few essential terminology and elements in order to comprehend health insurance completely:

The monthly (or annual) premium you pay for your health insurance coverage is known as the premium. The plan, your age, where you live, and the kind of coverage you choose can all affect premiums. Your insurance coverage remains current as long as you pay your premium.

Knowing the Fundamentals of Health

The amount you have to pay out of pocket for medical treatments before your insurance starts to cover them is known as the deductible. For instance, you would be responsible for paying the first $1,000 of medical bills if you had a $1,000 deductible.Knowing the Fundamentals of Health Following that, your insurer will begin to pay for expenses, frequently in conjunction with coinsurance or copayments.

Copayment (Copay): A copayment is a set sum of money you pay for a particular medical service, such $10 for a prescription or $20 for a doctor’s appointment.Knowing the Fundamentals of Health Typically, you pay this The maximum amount you will pay in deductibles, copayments, and coinsurance for medical treatments.

that are covered during a policy period (often one year) is known as the Out-of-Pocket Maximum (OOPM). The insurance provider pays for all of your medical bills for the remainder of the year after you reach your OOPM.

Network: Most health insurance plans have a group of physicians, hospitals, and other healthcare providers that they have contracts with to offer services at a reduced cost. In-network providers are typically less expensive than out-of-network providers, which could lead to higher out-of-pocket expenses.

Health Insurance Plan Types

There are numerous varieties of health insurance, each with varying pricing and coverage levels. Common forms of health insurance programs include the following:

Health Maintenance Organization (HMO): Under HMO plans, members must select a primary care physician (PCP) and obtain specialist referrals from the PCP. Usually, a network of physicians and hospitals provides care. HMO plans give less freedom in selecting healthcare providers but frequently have lower premiums and out-of-pocket expenses.

PPO: PPO plans give members greater freedom in selecting medical professionals and eliminate the need for referrals to consult specialists. But going to providers who are not in your network will cost more. PPOs offer members greater flexibility over their healthcare options, but they typically have higher rates than HMOs.

PPO and HMO components are combined in Exclusive Provider Organization (EPO) plans. They usually only cover services from in-network providers, but they do not require referrals to see specialists like PPOs do. Except in cases of emergency, out-of-network care is typically not covered.

Point of Service (POS): Plans for POS combine elements of PPO and HMO plans. Although members must obtain referrals to see specialists after selecting a primary care provider, they can also choose to go out-of-network for High Deductible Health Plans (HDHPs): These plans feature reduced premiums but greater deductibles.

Health Savings Accounts (HSAs), which enable people to save aside tax-free funds for medical costs, are frequently combined with these programs. They are a well-liked option for those who wish to reduce their rates and are normally healthy.

Catastrophic Health Insurance: Designed to safeguard you in the event of a major medical emergency or natural disaster, catastrophic policies offer very little coverage. These plans have exceptionally high deductibles but inexpensive premiums. Young, healthy people or those with very little money can frequently access them.

The Operation of Health Insurance

The way health insurance operates is that the policyholder and the insurer split the cost of medical treatment. Here’s a simple illustration of how it operates:

You have to pay

Depending on the conditions of your policy,Knowing the Fundamentals of Health your insurance company will pay the remaining Knowing the Fundamentals of Health amount for services.

Here’s how it might work, for instance, if you had a $1,000 deductible, a 20% coinsurance, and a $5,000 maximum out-of-pocket:

Assuming you haven’t yet Knowing the Fundamentals of Health reached your deductible, you might have to pay the full $300 bill out of pocket if you visit a doctor.

You would pay your $1,000 deductible first if you had surgery that cost $10,000. After that, you would pay $1,800, or 20% of the remaining $9,000.

The remaining expenses will be covered by your insurer. Your insurance would pay for all further expenses for the remainder of the year if your out-of-pocket spending exceeded your OOPM

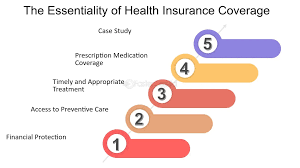

The Value of Health

In conclusion

Knowing the fundamentals of how health insurance operates will help you select the best plan for your requirements. Health insurance is a crucial defense against excessive medical expenses. Even though choosing a health insurance plan can be difficult at first, spending some time learning about the various plan types, deductibles, copayments, coinsurance, and premiums will help you make wise choices that will safeguard both your financial security and your health.