Health Insurance’s Function in the Management of Chronic Illnesses

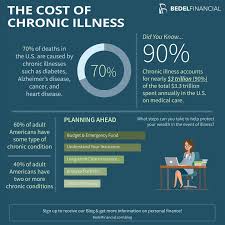

Millions of individuals worldwide suffer from chronic illnesses like diabetes, heart disease, arthritis, asthma, and high blood pressure. These illnesses frequently necessitate ongoing care, regular checkups, prescription drugs, and lifestyle modifications.

Health insurance is essential for managing the cost of continuing treatment, promoting general well-being, and guaranteeing access to care for people with chronic illnesses. This article examines the vital role health insurance plays in managing long-term illnesses and emphasizes how it enhances quality of life and health outcomes Management

- Availability of Routine Care and Monitoring

Access to regular, ongoing medical care is one of the most significant advantages of health insurance for people with long-term illnesses. Regular check-ups, lab testing, and doctor visits are frequently necessary for chronic conditions in order to track progress, modify medication, and avoid complications. Access to and affordability of these crucial healthcare treatments are facilitated by health insurance.

For many people, the expense of routine medical checkups and diagnostic testing could be unaffordable without insurance. People who have insurance can make routine visits with experts, go to screenings, and get preventative care, which can postpone the start of difficulties or perhaps stop the condition from getting worse. Effective management of chronic illnesses requires early attention, and insurance is essential for making Coverage and Cost of Medication

Health Insurance’s Function in the Management of Chronic Illnesses

Long-term drug regimens are frequently necessary for chronic illnesses. These prescription pharmaceuticals can be expensive, particularly if more than one prescription is needed or if treatment calls for more expensive, newer treatments. Prescription drug costs are partially covered by health insurance, which frequently lowers patients’ out-of-pocket costs.

Adherence to medicine is essential for people with chronic diseases. Patients may be forced to cut their medicine consumption, skip doses, Management or discontinue therapy entirely if they are unable to pay for their prescription medications.

Complications, hospital stays, or deteriorating health outcomes may result from this. Patients who have insurance are more likely to have access to the prescription drugs they require, which improves illness management and lowers avoidable consequences.

Furthermore, a lot of health plans provide specific programs for those with long-term illnesses like diabetes or heart disease.Management These programs may include discounts, pharmacy counseling services, or access to less expensive generic or name-brand medications. In addition to efficiently managing their health, this can assist people in continuing to take their medications as prescribed.

- Programs for the Management of Chronic Illnesses

For those with long-term illnesses, health insurance companies are increasingly providing disease management plans. The purpose of these programs is to assist people better manage their health by offering continuous support and coordinated care. They frequently include of health coaching, individualized treatment plans, frequent check-ins with medical specialists, and educational materials.

A health insurance plan might, for instance, provide a dedicated nurse or care coordinator to assist diabetic patients in monitoring their blood sugar levels and taking their medications as prescribed.

Health insurance companies hope to lower ER visits, decrease hospitalizations, and enhance patients’ overall quality of life by providing chronic illness management services. Better knowledge of the ailment, fewer complications, and reduced healthcare costs are frequently the outcomes.

- Lowering Cost-Related Care Barriers

Chronic illness management can be costly, as the expenses of prescription drugs, doctor visits, and hospital stays mount up over time. These expenses can become prohibitive for those without health insurance, which makes many people forego care or essential treatments.

A significant amount of the expense of healthcare is covered by health insurance, which lessens the financial burden. This covers medical examinations, tests, operations, hospital stays, and prescription drugs. Additionally, the majority of health plans have an out-of-pocket cap that restricts the overall Availability of Specialized Care and Therapies

A primary care physician is not equipped to provide the specialist care needed for many chronic diseases. Access to specialists with the knowledge and skills to treat particular disorders, such as cardiologists, endocrinologists, pulmonologists, and orthopedic surgeons, is guaranteed by health insurance.

Furthermore, health insurance is frequently essential for people with diseases like cancer, multiple sclerosis, or autoimmune disorders in order to obtain cutting-edge therapy including surgeries, biologic therapies, and the newest medical technology. Many patients would not be able to afford the hefty expense of these therapies without insurance.

Effective treatment of chronic illnesses and the provision of the best therapies to enhance patients’ health and quality of life depend on specialized care.

Emotional Support and Mental Health Therapy, counseling, and psychiatric care are among the mental health therapies that are frequently covered by health insurance. To deal with the emotional strain of managing a chronic illness, persons with chronic disorders must have access to mental health assistance. In order to help patients better manage their chronic disease, mental health specialists can assist them in creating coping mechanisms, lowering stress levels, and improving their general well-being.

Promoting Healthy Lifestyle Choices and Preventive Care

Preventive care can help people with chronic diseases avoid complications and improve their long-term health outcomes, which is why many health insurance plans place a strong emphasis on it. In addition to immunizations, wellness examinations, and lifestyle advice, preventive treatments may involve screenings for diabetes, high blood pressure, and cholesterol.

Furthermore, insurance policies frequently pay for smoking cessation, weight management programs, and other medical treatments meant to enhance general wellness. A better lifestyle can greatly lower the risk of complications and enhance illness control for people with chronic conditions. Patients who have health insurance are better equipped to take charge of their health by having easier access to these preventive actions.

In conclusion

Because it gives people access to essential medical services, prescription drugs, specialist treatment, and support networks, health insurance is essential for helping people manage chronic illnesses. It guarantees that patients have the resources necessary to properly manage their health and lessens the financial burden of ongoing treatment.

Additionally, health insurance promotes access to mental health care, medication adherence, and early intervention—all of which lead to better health outcomes and a higher quality of life. The significance of health insurance in addressing chronic illnesses will only get more important as their incidence rises worldwide. Ensuring that people with chronic diseases to live longer, healthier lives requires comprehensive insurance policies that cover a wide range of healthcare services, from preventative care to specialized treatments and routine checkups.