Which Is Better for You: Fully Insured or Self-Employed Health Plans

People frequently have to choose between fully insured and self-employed health insurance plans when it comes to health insurance. Depending on the individual’s unique needs, the nature of their job, and their financial status, each form of coverage has unique benefits and drawbacks. Making the greatest choice for your health and financial well-being requires knowing the distinctions between fully insured plans and self-employed insurance.

Self-Employed Health Plans: What Are They?

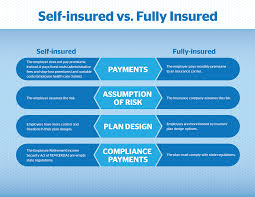

Self-employed health insurance plans, also known as individual health insurance plans, are those that you buy straight from a private insurance company as opposed to via a group plan or your employer. This kind of plan allows you to select your coverage, provider, and network independently of a larger organization if you operate for yourself or as a freelancer.

Self-employed people have two options for purchasing plans: private brokers or the Health Insurance Marketplace, which was created under the Affordable Care Act. These plans are intended for people like contractors, freelancers, and small business owners who are not eligible for employer-sponsored insurance.

Self-Employed Health Plans’ Benefits

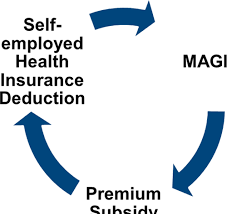

Control and Flexibility: Being self-employed gives you the freedom to Tax Deductions: Health insurance premiums are normally deductible from taxable income for self-employed people, lowering the amount of income that is subject to taxes. For freelancers and small business owners, this deduction can be very advantageous.

Portability: Since self-employed health plans are not dependent on your employer or employment, you can maintain your coverage in the event of a job change, relocation, or other career transition.

Protections under the Affordable Care Act (ACA): Your plan will comply with the ACA if you buy insurance through the Health Insurance Marketplace, providing benefits like co-pay-free preventative care and coverage for pre-existing diseases.

Self-employed health plans’ drawbacks include:

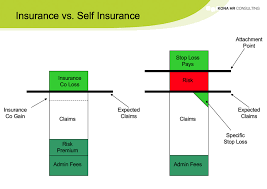

Higher Costs: Because the person is responsible for paying all premiums, self-employed health plans can occasionally be more costly than employer-sponsored policies. In group plans, employers usually pay a percentage of the premiums, which reduces the total cost to workers.

Restricted Access to Group pricing: If you work for yourself, you are not able to take advantage of the same group pricing that big companies provide to their staff. This implies that premiums may be higher, particularly if you live in a location with fewer insurance carriers or have few options for providers.

Risk of Inadequate Coverage: Because you are in charge of picking the plan, you run the risk of picking coverage that is insufficient. Some independent contractors could attempt to cut costs by selecting a A fully insured health plan: what is it?

Usually, an employer offers its workers a fully covered health plan in which the employer covers the cost of the health insurance premium. Under this structure, the financial risk of covering covered medical bills rests with the insurance company.

Employers and small business owners who purchase a group insurance plan from an insurance carrier and whose employees are typically covered by it are said to have a fully insured health plan. Fully insured plans, in contrast to self-employed plans, can be all-inclusive and frequently cover hospital stays, prescription medication, and preventative care.

Benefits of Health Plans with Complete Insurance:

Reduced Employee Premiums: In the majority of fully insured plans, the employer pays a percentage of the premiums.

Shared Risk: Unlike self-employed plans, where each employee bears all risk, fully insured plans distribute the risk of excessive medical expenses among all employees, potentially lessening the financial strain on any one individual.

No Direct Bargaining with Insurance Companies: Workers covered by fully insured plans are spared the trouble of comparing insurance policies and haggling over rates. The process may be made simpler because the employer manages the relationship with the insurer.

Fully Insured Health Plans’ Drawbacks

Limited Plan Customization: Employees usually have fewer options for tailoring the plan to their own healthcare requirements because the coverage is intended for a group.

Employer Dependency: If you have a job and are covered by a health plan that offers complete insurance,

Fully Insured or Self-Employed Health Plans

Increased Premiums for companies: Fully insured policies can be costly for companies, particularly small firms. This could lead to increased premiums or restrictions on the perks that the business can provide to its workers.

What’s the Best Plan for You?

A number of variables, such as your work status, medical requirements, and financial condition, will influence your decision between a fully insured health plan and a self-employed health plan.

For Self-Employed People: Self-employed plans provide flexibility and can be a fantastic choice for people who require specialized coverage, whether you’re a freelancer, contractor, or business owner. Even if the premiums themselves could be costlier, there is an extra benefit: the opportunity to deduct premiums from taxes.

For Workers: It’s usually an affordable and all-inclusive choice if you work for a company that has a fully covered health plan. The plan frequently offers more stability and coverage, and the employer contribution lessens the premium load. But if you’re thinking about switching careers,

In conclusion, each type of health plan—self-employed and fully insured—has its own advantages and disadvantages. To choose the kind of health insurance that best suits your lifestyle, it’s important to thoroughly consider your options based on your financial circumstances, employment status, and health requirements.