How to Pick Your Family’s Best Health Insurance Plan

One of the most crucial financial decisions you will make is choosing the best health insurance plan for your family. It affects not just the health of your family but also your spending plan, long-term financial stability, and general peace of mind. The procedure might be overwhelming due to the large number of plans, coverage options, and providers offered. You may, however, make an informed and certain choice if you are aware of the important variables that affect the best option for your family’s needs.

This comprehensive guide will assist you in selecting the best health insurance plan for your family:

- Determine the Healthcare Needs of Your Family

Assessing each family member’s healthcare needs is the first step in selecting the best health insurance plan. Think about:

Present Health Status: Is there anyone with ongoing medical needs or chronic conditions? Do any kids require routine checkups or pediatric care? Do you or your partner require prescription drugs?

Medical History: Previous procedures, hospital stays, or therapies may provide information about the type of coverage that may be required.

Anticipated Medical Services: Are you preparing for a big life event, like getting pregnant or having surgery? Will anyone need counseling or specialized care?

You may prioritize the things you need from your insurance plan by being aware of these demands.

- Recognize the Different Kinds of Health Insurance Plans

There are several varieties of health insurance, each with advantages and disadvantages. Among the most prevalent kinds are:

In exchange for a reduced premium, members of a health maintenance organization (HMO) must select a primary care physician (PCP) and obtain referrals to specialists. Your options for care may be limited because, typically, you can only use providers that are part of the plan’s network.

More options are available when selecting medical professionals and specialists thanks to PPOs. Referrals are not required, and you can see any physician; however, it will cost extra to see an out-of-network practitioner.

PPOs and exclusive provider organizations (EPOs) are comparable, except EPOs have a smaller network. Except in cases of emergency, out-of-network care is not covered.

Best Health Insurance Plan

The Point of Service (POS) integrates the characteristics of Cost, flexibility, and coverage requirements must all be balanced in order to select the best kind. PPO or POS may be the best option if your family values flexibility and is willing to pay higher premiums. An HMO can be the best option if you are willing to accept a more constrained network and desire cheaper premiums.

- Assess the Coverage of the Plan

Plans for health insurance might differ greatly in what they cover. Take into account the following while assessing a plan:

Inpatient and Outpatient Care: Verify if the plan includes coverage for both inpatient hospital stays and outpatient doctor visits or treatments that don’t necessitate overnight stays.

Maternity, Pediatrics, and Family Care: Verify that the plan includes coverage for prenatal care, labor and delivery, pediatric care, and family care if you intend to expand your family or have small children.

Dental and Vision Care: While dental and vision care may be offered as distinct add-ons by certain plans, it may be included in others. Verify whether these services are covered or accessible as optional coverage if they are significant.

- Examine the expenses

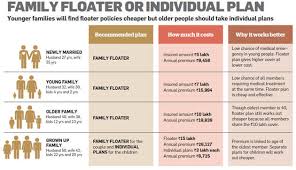

When selecting a health insurance plan, cost is frequently the most important consideration. Consider the following while comparing plans:

Premiums: These represent the insurance’s monthly cost. Although cheaper premiums may seem alluring, they frequently have more out-of-pocket expenses, like as copays and deductibles.

The amount you have to fork up before your insurance begins to pay for medical bills is known as your deductible. Although premiums for high-deductible plans are usually lower, they may be more costly if you require extensive medical care.

The expenses you incur when receiving medical services (like as doctor visits, prescription drugs, or ER care) are known as copayments and coinsurance. Examine the costs associated with various service categories.

Maximum Out-of-Pocket: This Despite the temptation to select a low-premium plan, make sure to account for out-of-pocket costs and deductibles when determining the overall cost of care. If you expect frequent medical needs, a plan with higher premiums may end up saving you more money over time.

- Examine the Network of Providers

A network of physicians, hospitals, and other healthcare providers is frequently included in health insurance plans. Verifying whether the present medical professionals in your family—or your preferred specialists—are covered by the network is essential.

In-Network vs. Out-of-Network: Prices for services from in-network providers are often lower than those from out-of-network ones. You can watch out-of-network providers with certain plans, but this can be costly.

Convenience and Access: Verify the accessibility and availability of the plan’s network providers, particularly Examine Plan Reviews and Ratings

Numerous independent organizations, including the Centers for Medicare & Medicaid Services (CMS) and the National Committee for Quality Assurance (NCQA), rate health insurance plans according to criteria like quality of care, customer service, and claim processing. You can evaluate the insurer’s repute and dependability with the aid of these ratings.

Read other policyholders’ reviews as well; they can offer firsthand accounts of how simple it is to submit claims, get care, and deal with customer support concerns.

- Examine the Flexibility of the Plan

Selecting a plan that can alter to accommodate your family’s changing needs is crucial because healthcare demands can change over time. For instance:

Changing Healthcare Providers: If you expect to switch healthcare providers in the future (for example,

- Take into Account Extras and Benefits

Additional benefits are provided by certain health insurance plans, including:

Telemedicine Services: For follow-ups and non-emergency consultations, virtual medical visits can be a practical choice.

Health & Wellness Programs: Certain insurance companies provide discounts or initiatives pertaining to mental health, weight loss, exercise, or quitting smoking.

Coverage of Alternative Medicine: For certain families, alternative therapies like acupuncture and chiropractic adjustments may be crucial. Verify whether the plan covers these.

- Examine the fine print.

Examine the terms and conditions of the plan thoroughly before deciding. Be mindful of:

Limitations and Exclusions: Be careful to comprehend any restrictions on coverage as each insurance plan includes exclusions, or what isn’t covered.

Emergency Services: Verify the plan’s emergency coverage, particularly if you live far from in-network providers or are traveling.

Claims Procedure: Recognize the steps involved in submitting claims and the timeframe for payment.

- Speak with an advisor or broker for insurance

Think about speaking with an insurance broker or advisor if you’re still not sure which plan is ideal for your family. They can assist you in weighing your selections, comprehending the specifics of various plans, and even locating tax credits or subsidies that can be relevant to your circumstances.

In conclusion

Cost, coverage, flexibility, and your family’s unique medical requirements must all be considered when selecting the best health insurance plan. You can choose a plan that fits your budget and offers the required care by carefully weighing these variables and conducting in-depth research.

Your family’s health and financial stability can be secured for many years to come if you take the time to comprehend your options and select the appropriate coverage.