What You Should Know About Young Adult Health Insurance

For young adults who are just beginning to understand the world of health care, bills, and coverage alternatives, health insurance might feel like a complicated maze. Even though it can seem like something that’s “for later,” getting quality health insurance at a young age is essential for your financial and physical health. Here is all the information you require for young adults’ health insurance.

Why Do Young Adults Need Health Insurance

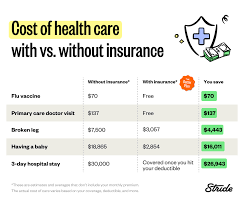

You may feel indestructible as a young adult, as if health issues are unimportant. However, accidents, unforeseen illnesses, and mental health issues can happen to even the healthiest people since life is unpredictable. The expenses of medical care can be prohibitive if you don’t have insurance.

Preventive care: Vaccinations, screenings, and checkups are examples of preventive services that are frequently covered by health insurance and can help you avoid or identify health risks early.

Access to Physicians and Specialists:.

Whether you need a normal checkup with your doctor or a consultation with a specialist, having insurance guarantees that you can get the treatment you require.

Emergency Care: When accidents or unexpected diseases occur, health insurance can assist in defraying the frequently exorbitant expenses of ER visits orMental Health Services: Support for mental health is essential, particularly for young adults. Medication, counseling, and therapy may be partially covered by health insurance.

Protection against Exorbitant Medical Expenses: In the absence of insurance, a single medical crisis could result in substantial debt. The amount of money you must spend out of pocket for care is limited by insurance.

Young Adult Health Insurance Types

You have a number of choices when it comes to obtaining health insurance as a young adult. The first step in choosing the best plan for your needs and budget is to understand your options.

Remaining on a Parent’s Plan (till age 26): Young individuals are permitted to continue on their parent’s health insurance plan until they are 26 thanks to the Affordable Care Act (ACA). For a lot of young individuals, this is among the greatest choices.

Marketplace Health Insurance: You can buy insurance through the Health Insurance Marketplace (sometimes called the Exchange) if you are no longer qualified for your parent’s plan. A range of plans are available in the marketplace, such as Bronze plans,

which have lower monthly premiums and greater deductibles, and Platinum plans, which are more costly but have reduced out-of-pocket expenses. You might be eligible for subsidies to lower the cost of these plans, depending on your income.

Employer-sponsored insurance may be a fantastic choice if you are employed and your company provides health insurance. Because the employer normally covers a portion of the cost, employer plans tend to have lower rates and better coverage.

Examine all of your options,

including coverage, monthly premiums, deductibles, co-pays, and out-of-pocket expenses, if your company offers you insurance.

Medicaid: Medicaid offers low-income people free or inexpensive coverage. Medicaid may be a great choice for health insurance if you fulfill the eligibility standards based on your income and other variables. State-specific eligibility requirements differ, so it’s critical to confirm the restrictions in your area.

Important Words to Understand When Selecting Health Insurance

It’s critical to comprehend a few key health insurance terminology before selecting a plan:

The monthly sum you pay for health insurance is known as the premium.

The amount you must pay out of pocket for medical services prior to your insurance taking effect is known as your deductible.

Co-pay: The set sum you pay after reaching your deductible for an approved medical service (such as a visit to the doctor).

Co-insurance: The portion of expenses that you and your insurance cover after In-network vs. Out-of-network: In-network providers are medical professionals or facilities who have a contract with your insurance plan that allows them to treat you at a reduced cost. These agreements do not apply to out-of-network providers, and their services may be more expensive.

How to Pick the Best Plan

Your health, financial situation, and future requirements all play a role in selecting the best health insurance plan. When assessing plans, keep the following points in mind:

Budget: Consider your out-of-pocket expenses, deductible, and monthly premium. In the event of a medical emergency, a plan with a low premium may appear alluring, but it may also have hefty deductibles or co-pays.

Health Needs: A high-deductible, low-premium plan is a good choice if you’re typically healthy and don’t anticipate needing much care.

Extra Benefits: Seek out plans that provide additional services like dental and vision care, although these might not be covered by all basic health insurance.

Mental Health and Wellness: For many young individuals, mental health services are essential. When selecting a health plan, it’s important to take into account that some provide superior coverage for counseling, therapy, and prescription drugs.

Health Insurance for Independent Contractors and Self-Employed People

Finding health insurance can be more difficult for young adults who work for themselves or as freelancers, but it is still feasible.

You can join a trade or professional association that provides group coverage, or you can purchase a plan through the Marketplace. Additionally, several states offer programs that help small business owners and independent contractors get reasonably priced health insurance.

Why Long-Term Planning Is Important