The Morality of Refusing Health Insurance

Handling the Tightrope Between Patient Care and Profit

The purpose of health insurance is to protect people from the crippling expenses of medical care by acting as a safety net and financial cushion. But there are significant ethical questions raised by the denials of health insurance.

Morality

Denying coverage for an operation, treatment, or prescription has a significant impact on the policyholder’s health, quality of life, and in certain situations, survival, in addition to their financial security. It begs the question:Morality Is it moral to refuse health insurance? We must investigate this matter by looking at the justifications for these denials, the ethical obligations of insurers, and the wider societal ramifications.

The Function of Health Insurance

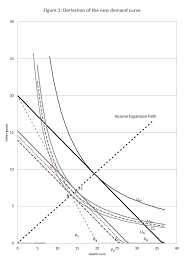

Providers of health insurance act as a bridge between those in need of healthcare services and those providers. In exchange for policyholders paying premiums, insurers agree to pay a percentage of medical expenses.

Health insurance should ideally serve as a safeguard against the financial strain of severe disease or damage, guaranteeing access to required medical care without having disastrous financial repercussions.

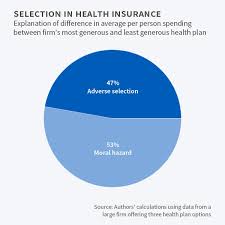

However, there are moral concerns with the way insurers Morality handle claims and decide what coverage to offer. Profit is the primary motivator for insurance firms.

Rejecting claims, restricting benefits, or labeling procedures as “not medically necessary” can all boost their bottoms. This leads to a conflict between the policyholder’s welfare and the insurer’s commercial objectives.

Morality

There are several reasons why people are denied health insurance.

There are several reasons why people are denied health insurance. Among the most prevalent are:

Among the most prevalent are:

Pre-existing diseases: Frequently claiming exclusions or waiting periods, many insurers refuse reimbursement for treatments associated with pre-existing diseases.

Insurance companies may contend that a particular treatment or operation is not “medically necessary,” even if a doctor has recommended it.

Experimental Treatments: Even if there is proof of the effectiveness of a new treatment or medication, it may be considered “experimental” and not covered.

Administrative Errors: Sometimes denials are just the consequence of obsolete information, clerical errors, or miscommunications.

Out-of-Network Providers: Even if the treatment is necessary, the insurer may refuse reimbursement if a patient chooses to see a medical professional who is not part of the network.

However, some denials The Moral Conundrum

The conflict between patient care and cost-effectiveness is at the heart of the ethics of health insurance denials. There are several moral precepts at issue:

Beneficence (Do No Harm): According to medical ethics, acting in the patient’s best interest should be the first priority for both insurers and healthcare providers. When a treatment is rejected, particularly one that a doctor has recommended, it raises concerns about whether the insurer is upholding its moral duty to put the welfare of the patient above its own bottom line.

Denying coverage can cause serious injury, including needless suffering or death, particularly in life-threatening circumstances.

Justice (Equal Access to Care): Health insurance is frequently presented as a way to guarantee that everyone has fair access to medical care. Refusing to provide coverage Autonomy (Patient Choice): The concept of patient autonomy may also be hampered by insurance refusals.

Patients are entitled to consult their healthcare providers when making decisions about their care. Patients may be pushed to select less effective or more expensive alternatives when insurance refuse to fund specific treatments.

This impairs their capacity to make independent, well-informed healthcare decisions.

Accountability and Transparency

Morality

: Making ethical decisions about health insurance necessitates a transparent procedure. Insurance companies should explain exactly what is covered and why some treatments might not be approved. They ought to be held responsible for their choices as well.

Because insurance firms frequently operate in opaque ways, customers frequently don’t know why their claims were rejected or how to properly challenge those decisions.

The Effect on Patients Morality

The effects that health insurance denials have on patients in the real world are the clearest indication of their ethical ramifications. Denials may lead to:

Delayed or Deferred Care: Because of the expense of paying out-of-pocket, patients may put off or completely forego critical treatments when an insurer rejects a claim. In certain situations, this delay may result in irreversible harm and impair health consequences.

Financial Hardship: The expense of medical care can be prohibitive for many people, and being denied coverage just makes matters worse.Morality The expenses of refused claims may drive patients to incur debt or even file for bankruptcy.

Psychological Toll: Patients and their families may experience mental distress as a result of dealing with insurance denials. The tension Potential Remedies

Although the moral dilemmas raised by health insurance denials are intricate, there are a number of possible reform paths:

Clearer Standards and Guidelines: It may be necessary for insurers to create more uniform and transparent standards for what qualifies as “medically necessary” care. This would lessen discriminatory or capricious denials.

Independent Review Panels: Reviewing denials by outside panels or medical professionals would add another level of supervision and guarantee that choices are made with the patient’s best interests in mind.

Better Appeal Procedures: The appeals procedure must to be easier to use, faster, and less combative. The emotional and financial strain of challenging an unfair denial shouldn’t be placed on patients.

Healthcare Reform: More broadly, changing the health insurance system to put patient care ahead of

In conclusion

The topic of health insurance denial ethics brings up important issues on how profit, healthcare, and human dignity interact. Insurers must strike a balance between patient care and business needs, but refusing coverage for financial reasons can be harmful, worsen inequality, and violate patient autonomy.

Making ethical decisions about health insurance necessitates a dedication to openness, equity, and the welfare of the people it serves. The ethical dilemmas raised by insurance denials will remain a major problem in healthcare until the system can reconcile these principles with its operational procedures.