How the Marketplace for Health Insurance Operates

A service that assists individuals, families, and small businesses in finding and acquiring health insurance is the Health Insurance Marketplace, sometimes referred to as the Health Insurance Exchange. The Marketplace was established by the Affordable Care Act (ACA) with the goal of lowering the cost and increasing access to health insurance.

You can use the Marketplace to examine different insurance plans, see if you qualify for subsidies, and sign up for coverage that fits your needs and price range. However, how does it operate exactly? Let’s dissect it.

The Health Insurance Marketplace What is it

You can browse, compare, and buy health insurance plans online at the Health Insurance Marketplace. The Affordable Care Act stipulates certain requirements that these plans must fulfill, such as providing basic health coverage like prescription medications, emergency services, maternity care, mental health services, and preventative care.

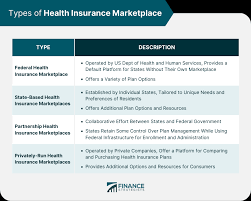

Marketplaces for health insurance come in two main varieties:

Federal Marketplace: Managed by HealthCare.gov on behalf of the federal government. It covers 38 states.

State-Based Marketplaces: A few states manage their own websites for their marketplaces. Among these states are California, New York, and Washington.

Who Can Use the Marketplace?

The Health Insurance Marketplace is available to:

- Individuals and families who do not have access to employer-sponsored health insurance.

- People without government-sponsored health insurance such as Medicaid, Medicare, or the Children’s Health Insurance Program (CHIP).

- Small businesses may also use the Small Business Health Options Program (SHOP) to offer health coverage to their employees.

The Marketplace is open for enrollment during specific periods each year, known as Open Enrollment. However, if you experience a Qualifying Life Event (QLE), such as getting married, having a baby, or losing other health coverage, you can apply for a Special Enrollment Period (SEP).

How Does the Market Operate?

Using the Health Insurance Marketplace is a fairly easy process that includes the following crucial steps:

Make an Account: You must first register for an account on the Marketplace. Giving personal details such your name, address, and household size will be required for this.

Provide Income Information You will be required to provide information about your household income because one of the primary goals of the Marketplace is to assist you in finding coverage that is affordable.

Your monthly premiums and out-of-pocket expenses may be reduced if the Marketplace determines that you are eligible for subsidies like the Premium Tax Credit or Cost-Sharing Reductions (CSR).

View Plans: You can view the various health insurance plans after entering your details.

Bronze: Higher out-of-pocket expenses, lowest premiums.

Silver: Costs and premiums are moderate.

Gold: Reduced out-of-pocket expenses and higher premiums.

Platinum: The lowest out-of-pocket expenses and the highest premiums

.

Each tier’s plans offer the same basic health benefits; the only difference is the amount you must pay out of pocket for medical care.

Plan Comparison: The available plans can be compared according to provider networks, out-of-pocket maximums, deductibles, and premiums. Additionally, the Marketplace will outline the coverage, including any exclusions or restrictions.

Check for Subsidies: The Marketplace will determine whether you are eligible for subsidies if you are eligible for help. Cost-Sharing Reductions (CSR) cut your out-of-pocket expenses, while the Premium Tax Credit helps lower your monthly premium.

like copayments and deductibles. Those with incomes between 100% and 400% of the federal poverty line are typically eligible for these subsidies.

Select a Plan: You can choose a plan and finish your registration after comparing plans to see which one best suits your requirements and financial situation. After that, your coverage will be activated when you pay your first premium to your insurer directly.

Ongoing Management: Following enrollment, you should monitor any changes to your household size or income as these may impact your eligibility for subsidies or the best plan for you. Anytime you like, you can use the Marketplace to change your information.

Principal Advantages of the Market

Costs that are subsidized: A large number of Marketplace users are eligible forThe purpose of sharing reductions is to lower the cost of health insurance for people with low incomes.

Standardized Plans: To help guarantee a basic level of coverage, all plans offered via the Marketplace must adhere to ACA requirements and offer essential health benefits.

No Health Status Discrimination: Pre-existing conditions cannot be used as an excuse by insurers to refuse coverage or raise premiums. One of the main characteristics of the ACA is this.

Transparency: The Marketplace facilitates side-by-side plan comparisons, enabling you to make a better informed choice. Clear details on coverage, expenses, and advantages are also provided by the internet platform.

Things to Take Into Account When Using the Marketplace

Even though there are many options available through the Health Insurance Marketplace, it’s crucial to comprehend a few crucial elements before signing up:

Network Limitations: Every plan has a unique network of physicians, medical facilities, and other healthcare providers. Make sure the hospital or doctor you currently see is covered by the plan; otherwise, you might have to pay more out of cash for care that is not covered by the plan.

Plan Costs: The cost equation includes more than just premiums. Plans can have very different deductibles, copayments, and out-of-pocket maximums. It’s important to think at the total cost of care, not simply the monthly payment.

Open Enrollment Periods: Unless you are eligible for a Special Enrollment Period, you can only enroll or switch plans during Open Enrollment. Unless you experience a qualifying life event, you might not be able to obtain coverage until the following year if you miss this opportunity.

Medicaid as well as

In conclusion

For Americans seeking reasonably priced health insurance, the Health Insurance Marketplace is a priceless resource. It makes choosing a plan easier and provides incentives to lower