The Function of Technology in the Management of Health Insurance

Thanks in large part to technological improvements, the health insurance business is going through a significant shift. Technological advancements over the last few decades have completely changed the way health insurance firms function, handle claims, offer customer support, and guarantee regulatory compliance. Technology is changing every facet of health insurance administration, from blockchain and telemedicine to artificial intelligence (AI) and machine learning, making it more transparent, customer-focused, and efficient.

- Administrative Process Automation

Automating ordinary administrative activities is one of the biggest ways that technology has improved the administration of health insurance. Health insurers have historically handled claims, policy administration, underwriting, and customer support through manual procedures. In addition to being time-consuming, this method was prone to human mistake, which resulted in delays and inefficiencies.

These tasks are becoming more efficient thanks to automation technology like workflow management systems and robotic process automation (RPA). By processing claims, confirming eligibility, updating policy details, and handling invoicing automatically, these systems can cut down on errors and administrative expenses. For instance, automated claim processing guarantees faster and more accurate adjudication of claims, enhancing the general customer experience.

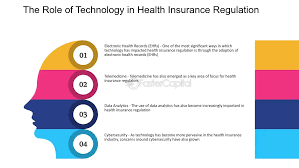

- Using Data Analytics to Make Decisions Data analytics is becoming a fundamental component of contemporary health insurance management. Large volumes of data are now available to insurers, including demographic data, claims history, and patient medical records. Health insurers can make better decisions on risk assessment, claims handling, and underwriting by utilizing this data with sophisticated analytics tools.

AI and machine learning-powered predictive analytics assists insurers in identifying high-risk individuals and improving claim management. Insurers, for example, can change rates, offer targeted wellness programs, or provide more individualized treatment interventions by predicting which patients are likely to have high healthcare costs in the future.

Technology in the Management of Health Insurance

Additionally, by examining trends and spotting irregularities in claims filings, data analytics can assist insurers in detecting fraud. By

- Tailored Client Experience

Health insurers can now more easily offer individualized consumer experiences thanks to technology. Insurance companies can customize their products to match the unique requirements of each client by utilizing data and sophisticated analytics. For instance, insurers can use consumer data to create personalized health plans, suggest preventative care initiatives, and provide wellness rewards based on each person’s unique health profile.

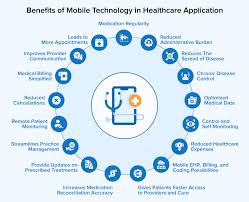

Customer service in the health insurance industry has also changed as a result of mobile apps and web portals. Through user-friendly interfaces, customers can now examine their coverage details, file claims, manage their medical spending, access their insurance information, and even make appointments. This improves customer happiness and retention while also making it simpler for customers to manage their health insurance.Virtual health services and telemedicine.

Telemedicine has emerged as a key element of contemporary healthcare, and its incorporation into health insurance policies is changing how insurers oversee the delivery of healthcare as well as how consumers obtain care. More convenience and affordability are provided by telehealth services, such as remote patient monitoring, mental health care, and virtual medical consultations, especially in underserved or rural locations.

Telemedicine offers insurers the chance to improve treatment delivery while reducing healthcare expenditures. Given the benefits telehealth offers in terms of better patient outcomes, convenience, and lower overall healthcare costs, many health insurance plans now include telehealth services.

Additionally, insurers can use the information gathered during telemedicine visits, including patient histories and health indicators, to monitor andBlockchain for Security and Transparency

Best recognized for its usage in cryptocurrencies, blockchain technology is becoming more and more popular in the management of health insurance due to its capacity to provide safe, transparent, and impenetrable record-keeping. Security and privacy are critical in an industry that frequently exchanges sensitive personal health information. From processing claims to updating policies, blockchain can help guarantee that every transaction is visible and safely documented.

For example, insurers can use blockchain technology to generate an unchangeable record of all claims and transactions that is simple to audit and validate. This lowers the possibility of fraud, streamlines the claims adjudication procedure, and guarantees that all stakeholders—policyholders, providers, and insurers—have access to the same correct data. Additionally, the technology facilitates insurers’ ability to

- Using Machine Learning and Artificial Intelligence to Process Claims

The use of AI and machine learning is becoming more and more important in enhancing the effectiveness and precision of claims processing. Large datasets may be swiftly analyzed by these technologies, which can also automate decision-making and spot trends. AI-powered systems can automatically evaluate claims, check if they satisfy the requirements for payment, and identify possible fraud in the context of claims administration.

Furthermore, AI can facilitate client interactions by empowering chatbots or intelligent virtual assistants to manage policy administration, respond to routine questions, and offer claims updates. These AI-powered solutions provide round-the-clock assistance, cutting down on wait times and raising client satisfaction.

Additionally, machine learning algorithms improve the underwriting process by examining an applicant’s lifestyle, medical history, and other pertinent information to Enhancing Adherence to Regulations

The insurance and healthcare industries are heavily regulated, and insurers must abide by a wide range of intricate rules and legislation. Although it has historically been a difficult undertaking, emerging technologies are assisting insurers in streamlining their compliance procedures.

Automation, artificial intelligence, and analytics are used by RegTech (regulatory technology) systems to track and guarantee compliance with regulations. Insurers may keep current and prevent expensive fines by using these tools to monitor changes in laws, rules, and policies. They can also automatically create audit trails and reports, which facilitates proving compliance in the event of regulatory inspections.

In conclusion

Technology plays a broad and revolutionary role in the administration of health insurance. Technology is changing the face of health insurance in a number of ways, from improving consumer experiences through telemedicine and mobile apps to automating administrative duties and using data analytics to make better decisions. In addition to increasing insurance companies’ competitiveness, these technologies are giving consumers better, more accessible healthcare options by increasing efficiency, cutting costs, increasing transparency, and facilitating more individualized care.

There is a great deal of room for improvement in the management of health insurance as technology develops. Incorporating cutting-edge technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT) promises to further enhance security, efficiency, and care management, making health insurance more widely available, reasonably priced, and