The Differences in Health Insurance Coverage by State

With major variations in coverage based on where you live, health insurance in the US can be a complicated and occasionally frustrating environment. States continue to have significant authority over some parts of health insurance, despite the Affordable Care Act’s (ACA) efforts to standardize and increase access to healthcare.

As a result, there are differences in availability

, cost, and coverage across the nation. This article will examine the variations in health insurance coverage by state and the variables that influence these variations.The Differences in Health Insurance Coverage by State

With major variations in coverage based on where you live, health insurance in the US can be a complicated and occasionally frustrating environment.

States continue to have significant authority over some parts of health insurance, despite the Affordable Care Act’s (ACA) efforts to standardize and increase access to healthcare. As a result, there are differences in availability, cost, and coverage across the nation.

This article will examine the variations in health insurance coverage by state and the variables that influence these variations.

- Medicaid Expansion: A Crucial Distinguisher

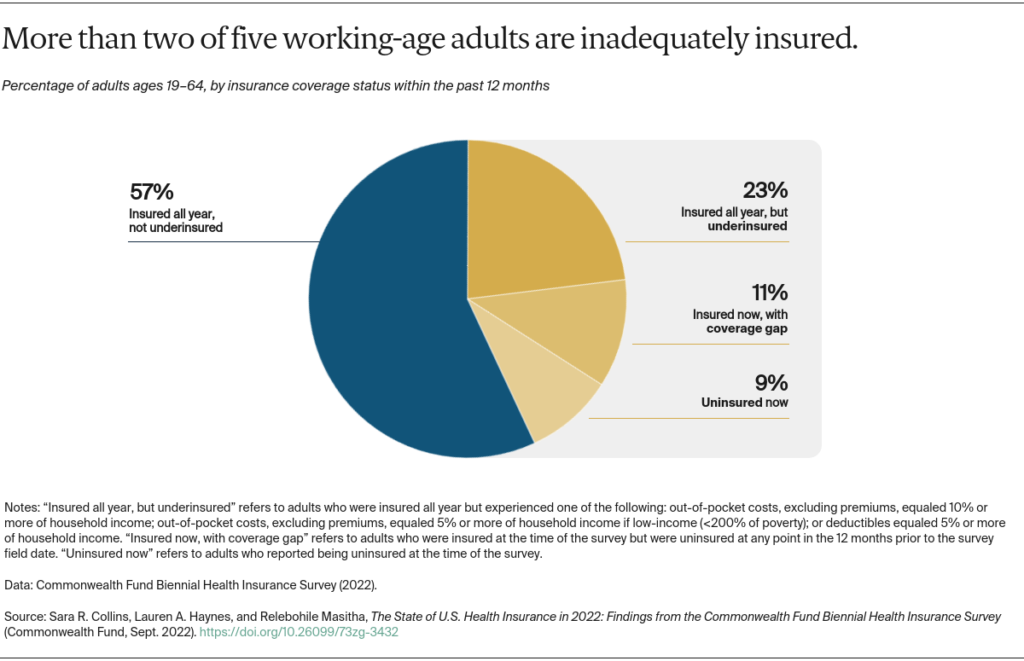

Medicaid expansion is one of the most important ways that health insurance coverage differs by state. The Affordable Care Act (ACA) allowed states to extend Medicaid eligibility to those earning up to 138% of the federal poverty line. But not all states made the decision to expand Medicaid, and as of 2024, 11 states remained opposed to the expansion.

The number of low-income citizens who now have access to healthcare coverage has significantly increased in states that have extended Medicaid, such as California, New York, and Massachusetts. Millions of people who might not otherwise be eligible for regular Medicaid or any other type of insurance now have coverage because to this expansion.

Uninsured rates are greater in states that did not expand Medicaid, such as Georgia, Florida, and Texas, particularly among those with lower incomes. This implies that even while they may still have trouble affording coverage, consumers in these states may have a harder time finding cheap health insurance or may not be eligible for Medicaid at all.

Access to healthcare has been directly impacted by this Medicaid expansion gap, as states that have expanded Medicaid typically have lower rates of uninsured people and more comprehensive alternatives for their citizens’ health coverage.

- Cost and Availability in the Marketplace

Additionally, the Affordable Care Act established state-based health insurance marketplaces, often known as exchanges, where small businesses and individuals may compare health insurance coverage. But not every state has its own marketplace. There are two primary categories of marketplace structures:

Marketplaces Based in States: States

Federally Facilitated Marketplace: The federally operated exchange at HealthCare.gov is used by states without their own marketplace. Although health insurance are accessible through this marketplace, customers in these states might have fewer alternatives, and the process may occasionally be less individualized than in state-run marketplaces.

The affordability of insurance for citizens in various jurisdictions is also impacted by the availability of subsidies, such as premium tax credits, which differ by geography and income. Because the Medicaid expansion gives low-income people a more straightforward and convenient way to obtain coverage, some states—especially those that implemented it—have lower overall rates of uninsured people.

- Protections and Regulations by States

The rules governing health insurance policies vary from state to state and can have a big influence on the costs and coverage possibilities. These rules

Essential Health Benefits: Ten essential health benefits, including maternity care, prescription medication, emergency services, and mental health services, must be included by all health insurance plans under the Affordable Care Act.

Some states place additional requirements on insurers, even though this is a federal requirement. States like Massachusetts and California, for instance, can mandate extra coverage, such more extensive mental health care or coverage for infertility treatments.

Mental Health Parity: Stricter mental health parity legislation in some states guarantee that treatment for mental health and drug use disorders is covered on the same terms as treatment for physical health illnesses. While mental health coverage may be more restricted in other states, states such as New York and Washington, D.C., have more robust protections.

Rate Regulation: States also control the amount that insurers can charge for out-of-pocket expenses and premiums. Stronger pricing controls in some areas, including as Minnesota and Oregon, can cut residents’ out-of-pocket expenses and premiums.

Conversely, less regulated areas like Texas and Alabama can experience more notable market price swings, which might make insurance more expensive.

- Access to Private Insurance and Employer Requirements

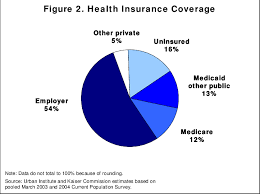

States differ in their provision of private health insurance through their companies, which is impacted by both state legislation and the overall situation of the economy. - While areas with higher rates of poverty may have fewer people with employer-sponsored insurance, states with bigger working-age populations may have higher levels of employer-provided coverage.

- Similar to the ACA’s requirement that companies with more than 50 employees provide insurance, certain states, including Massachusetts, have enacted employer mandates. While states without such regulations may see fewer firms offering coverage, these state-level mandates can assist raise the state’s overall covered population rate.

- Health Reforms and State Innovation Waivers

Many states have used state innovation waivers (Section 1332 waivers) to pursue their own health reforms in addition to the ACA. - These waivers enable states to enact alternative health insurance market policies, such as modifications to the structure of subsidies, the delivery of Medicaid, and the regulation of plans. Among the examples are:

- Alaska’s Reinsurance Program: Alaska established a reinsurance program through a 1332 waiver, which lowers individual premiums.

- The public option program in Colorado is currently being implemented with the goal of lowering the cost of health insurance by enabling citizens to enroll in a state-run insurance plan.

- However, these innovations differ greatly from state to state and are subject to rapid change depending on the political environment and leadership. As a result, the state-by-state variations in health insurance might be significant.

- In conclusion

- Access to care is greatly influenced by state-level decisions, and health insurance coverage in the United States is far from uniform. These differences, which range from state-specific laws to Medicaid expansion, result in a patchwork system that impacts millions of Americans. Although the Affordable Care Act sought to standardize several areas of healthcare access, states continue to have substantial control over important aspects of the