Knowing How Much Health Insurance Costs: Elements That Impact Premiums

The cost of health insurance can differ significantly across individuals and even between insurers. One of the most crucial considerations for consumers when selecting a health insurance plan is the cost of premiums. Premium pricing, however, can have a complicated structure that is impacted by a number of variables. By being aware of these variables, people can choose their health insurance more wisely and possibly save money.

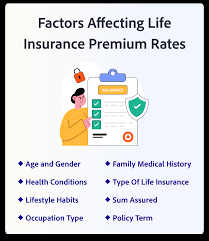

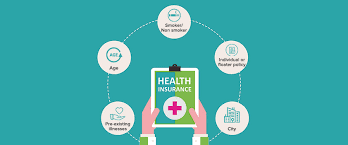

- Demographics and Age

One of the most important variables influencing health insurance rates is age. People usually have a higher chance of getting health issues as they age, which raises the cost of insurance. Older people typically have greater health care demands, and insurers base premiums on the possibility that they will require medical attention.

The Affordable Care Act (ACA) in the United States restricts the amount that insurers can charge based on an individual’s age. The maximum premium that insurers can charge an elderly policyholder is three times that of a younger policyholder. Despite this limitation, older persons will often pay more for health insurance than children or younger adults.

Premium pricing may also be influenced by gender. Historically, premiums for women have been higher.

- Place

Another important consideration when calculating the cost of health insurance is where you live. State-to-state and even within-state variations in premiums can be substantial. The availability of insurance carriers, regional risk pools, and local healthcare expenses all contribute to this discrepancy.

Healthcare Costs: Depending on the availability of healthcare professionals, the price of medical equipment, and other regional circumstances, the cost of medical care may be higher in some areas. Generally speaking, increased medical expenses result in higher premiums.

State Regulations: States have varying laws governing health insurance, such as the kinds of plans that must be offered and the extent of coverage that insurers must provide. Premiums may be higher in states with more stringent coverage requirements.

- Medical History and Current Health

Although this is more relevant to short-term plans and some non-ACA compliant policies, your health history has a big impact on your health insurance rates. People with chronic illnesses or past medical concerns have greatly benefited from the Affordable Care Act’s prohibition on insurers raising premiums based on pre-existing conditions.

However, insurers may consider an applicant’s medical history and raise prices for short-term health insurance plans or those bought outside of the ACA marketplaces if the applicant is more likely to incur future medical costs. This is among the factors that could result in higher premiums for those with poor health or pre-existing diseases.

- Type of Plan and Coverage Level

Your premiums may be considerably impacted by the kind of health insurance plan you select. Premiums are often higher for plans with more comprehensive coverage, which means they cover a larger percentage of medical costs.

Although Gold and Platinum Plans have higher monthly premiums, they usually have lower deductibles and cover a larger percentage of medical costs.

Although the monthly premiums for Bronze and Silver Plans may be lower, the deductibles and out-of-pocket expenses are higher.

You can reduce your premium by selecting a plan with a larger deductible, but you will have to pay more out of pocket for medical treatments when you need them. It’s critical to weigh your anticipated medical demands against the premium cost.

- Dependents and Family Size

The number of dependents you must cover will raise your premiums if you’re purchasing a family plan. Because family coverage increases the possibility that several people may require medical services, health insurance plans charge higher premiums for family coverage than for individual coverage.

The ages and health conditions of your dependents are also taken into account by insurers. The total cost of coverage may be impacted by the insurer if you have children or family members with long-term medical conditions.

Premiums

Lifestyle Decisions and Tobacco Use

People who lead healthy lifestyles and don’t smoke are frequently eligible for reduced insurance rates. Smokers may pay higher premiums because smoking is associated with greater health risks, like as cancer and respiratory illnesses.

- Network and Coverage Area of Insurance Plans

Premiums are also impacted by the network of medical professionals that are offered under a certain insurance plan. Plans for health insurance may have:

Health Maintenance Organizations, or HMOs, usually have cheaper premiums but place more limitations on the hospitals and doctors you can choose from. Referrals to see specialists might be necessary.

PPO (Preferred Provider Organization).

Although these plans typically have higher premiums, they give members more freedom in selecting medical professionals, even those who are not in their network.

Exclusive Provider Organizations, or EPOs, are comparable to PPOs but typically have stricter guidelines regarding the use of care that is not in the network.

Plans that allow you to see providers outside of your network or have a wider network are typically more expensive than those that only allow you to access providers inside your network.

- Individual versus Employer-Sponsored Plans

However, individual plans—whether bought directly from insurers or through the marketplace—might not offer the same cost-sharing advantages. Nonetheless, there are occasionally tax credits and subsidies available, which can help lower-income individuals purchase individual insurance.

- Financial Aid and Government Subsidies

Subsidies might lower premium prices for people buying health insurance through the ACA marketplace. These income-and household-size-based discounts can drastically reduce your premium costs. These subsidies were increased by the American Rescue Plan, which was passed in 2021, making coverage more accessible to a greater number of people.

Depending on their eligibility, those who are eligible for Medicaid or the Children’s Health Insurance Program (CHIP) may also pay minimal or no premiums.Inflation and Economic Factors

Lastly, the state of the economy as a whole may have an effect on health insurance rates.

Premiums may increase as a result of inflation in the healthcare industry, which includes growing hospital expenses, doctor fees, and medication costs. As insurers try to strike a balance between the expenses of claims and the premiums they receive, economic downturns can also have an impact on their pricing tactics.