Key Information for Consumers to Understand Health Insurance and Prescription Drug Coverage

Health insurance is essential in today’s healthcare system to guarantee access to medical services, including prescription medications. However, many consumers may find it daunting to navigate the intricacies of prescription drug coverage and insurance programs. With an emphasis on prescription medication coverage, this article attempts to simplify the fundamentals of health insurance and offer useful information about what customers should be aware of.

Health insurance: what is it

One sort of coverage that aids in covering hospital stays, medical expenses, and other health-related costs is health insurance. A range of services, including doctor visits, hospital stays, preventive care, and surgery, are usually included. Employers, government initiatives (such as Medicare or Medicaid), or private market buyers can all offer insurance.

Typically, a health insurance coverage includes a deductible (the amount you have to pay out of cash before insurance starts), a premium (a regular payment), and copayments or coinsurance (the portion of costs you pay when obtaining medical services). Because it helps avoid financial hardship in the event of unforeseen health difficulties and because it frequently offers improved access to a variety of healthcare providers, health insurance is crucial.

Coverage for Prescription Drugs: Essential Information

The portion of your health insurance plan that assists in covering prescription drugs is known as prescription drug coverage. This coverage is a crucial aspect of many health insurance policies because prescription medications can account for a sizable portion of medical costs. Prescription drug coverage makes it easier for people to afford the necessary therapy by lowering their out-of-pocket expenses for prescription drugs.

Common antibiotics and sophisticated treatments for long-term illnesses including diabetes, high blood pressure, and cancer are examples of prescription pharmaceuticals. Without prescription drug coverage, many people may not be able to pay the cost of these drugs, which could have a negative impact on their health.

Prescription Drug Plan Types

Most people who have health insurance do it through their work, which is known as employer-sponsored insurance. Prescription medication coverage is frequently included in employer-sponsored plans as part of the total package, however specifics may differ. Employees can select the plan that best meets their needs from a variety of options offered by some businesses.

Medicare Prescription Drug Coverage (Part D): Medicare offers prescription drug coverage under Part D to people 65 and older and people with specific impairments. Medicare-approved commercial insurance providers offer Part D policies. Medicare Advantage (Part C) plans, which combine prescription drug and medical coverage into a single plan, may incorporate these plans or they may be stand-alone plans.

Medicaid Covers Prescription Drugs: Medicaid is a federal and state program.

Marketplace policies: The Affordable Care Act (ACA) created the Health Insurance Marketplace, which provides individual health insurance policies, many of which cover prescription drugs. The drugs that are covered and the accompanying prices differ throughout marketplace plans. There are various plan tiers available to consumers, some of which provide more extensive drug coverage.

Health Insurance and Prescription Drug Coverage

The Operation of Prescription Drug Coverage

A formulary, which is a list of drugs that are covered by the plan, is usually how prescription drug coverage works. Depending on their availability and cost, medications are frequently categorized into several categories. Higher tiers typically contain the more costly drugs, and consumers may be responsible for a greater percentage of the cost.

This is how it usually operates:

Formulary: A list of prescription medications that are covered by health insurance policies is kept up to date by the plans. The medications are divided into various “tiers” according to their price and potency. Consumers typically pay less for medications in lower tiers, whereas higher tier medications can be more costly.

Copayments and Coinsurance: For prescription medications, the majority of plans impose a copayment, which is a set amount, or a coinsurance, which is a portion of the cost. For instance, you might spend $40 on a name-brand drug and $10 on a generic. A larger copayment or coinsurance percentage might be necessary for higher-tier medications.

Preferred versus Non-Preferred Drugs: “Preferred” and “non-preferred” medications are frequently distinguished by health insurance policies. Drugs that the insurer has negotiated a cheaper price for are considered preferred.

Compared to brand-name medications, generic medications are usually less expensive since they use the same active components but are marketed under a different name. In order to save money for both the insurer and the patient, the majority of health insurance plans promote the use of generic medications. However, if their doctor prescribes brand-name medications, consumers might still be able to obtain them.

Specialty pharmaceuticals are expensive prescription treatments that are frequently used to treat uncommon or complicated illnesses like multiple sclerosis, rheumatoid arthritis, and cancer. These pharmaceuticals can be given by injection or infusion, and they can be far more expensive than regular prescription meds. To help control the high costs, some health plans provide special programs or separate coverage for prescription medications.

Out-of-pocket expenses and costs

Even with prescription drug coverage, the type of medication, its formulary tier, and the insurance plan can all have a big impact on out-of-pocket expenses. The following are the main cost factors:

Premiums: The monthly payments required to maintain your health insurance coverage are known as premiums. The premiums for more basic health insurance policies with limited medication coverage may be lower than those for higher-tier plans with comprehensive drug coverage.

Deductibles: Prior to your health insurance plan starting to cover prescription medications, you may need to pay a deductible. Depending on the plan, deductibles can vary significantly.

Out-of-Pocket Maximums: The amount you spend for medical services (including prescription medications) during a given year is limited by out-of-pocket maximums in health insurance policies.

Co-pays and Coinsurance: You can still be required to pay a copayment or coinsurance for prescription drugs even after the deductible has been satisfied. Depending on the medication and its formulary tier, the amount may change.

Managing Coverage for Prescription Drugs

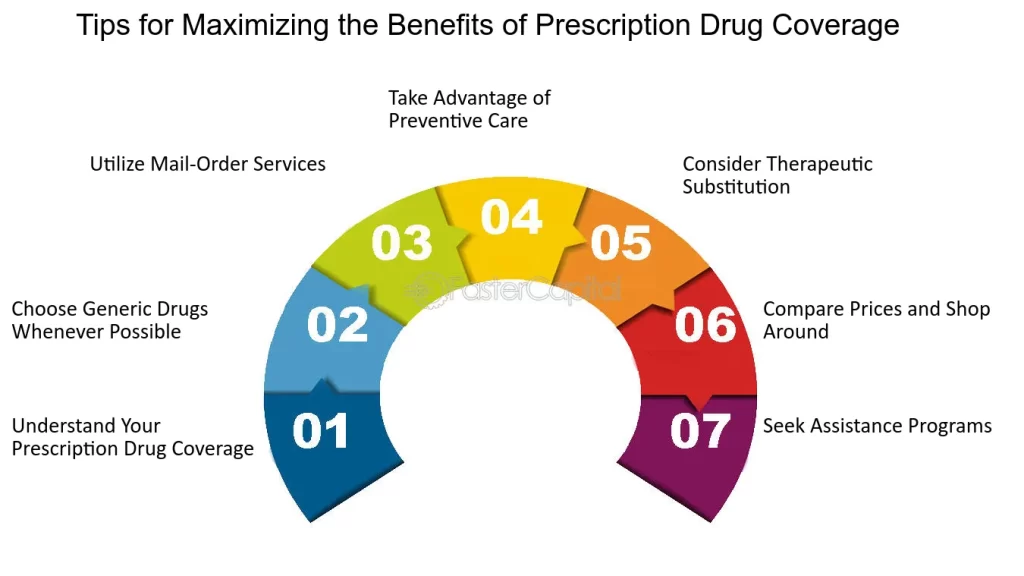

The following advice will help you get the most out of your prescription medicine coverage:

Examine the formulary for your plan before filling a prescription to make sure the medication is covered and to find out how much it will cost. If your physician recommends a high-tier or non-formulary medication, inquire about less expensive alternatives.

Take Generic Drugs into Account: Generic medications are usually less costly and function just as well as their name-brand equivalents. Ask your doctor whether there is a generic version of the medication you are taking.Look for Savings Programs: A lot of pharmaceutical companies provide patient help or discount programs for specific drugs. For expensive medications, they can assist lower out-of-pocket expenses.

Use Mail-Order Pharmacies: For people who need long-term prescriptions, mail-order pharmacy services offered by certain insurance plans can lower the cost of prescription drugs.

Consult Your Physician: Consult your physician if the expense of a prescription drug is preventing you from receiving treatment. They can be able to recommend a less costly substitute or point you in the direction of initiatives to assist with prescription drug expenses.

In conclusion

In order to control healthcare expenses and guarantee that people have access to the prescription drugs they require, health insurance and prescription drug coverage are crucial. Customers may choose their healthcare plans wisely if they are aware of the fundamentals of prescription drug coverage, such as formularies, tiers, and cost-sharing arrangements. Having the appropriate prescription medication coverage, whether through employer-sponsored insurance, Medicare, Medicaid, or individual plans from the Marketplace, can significantly impact how you manage your health and finances.